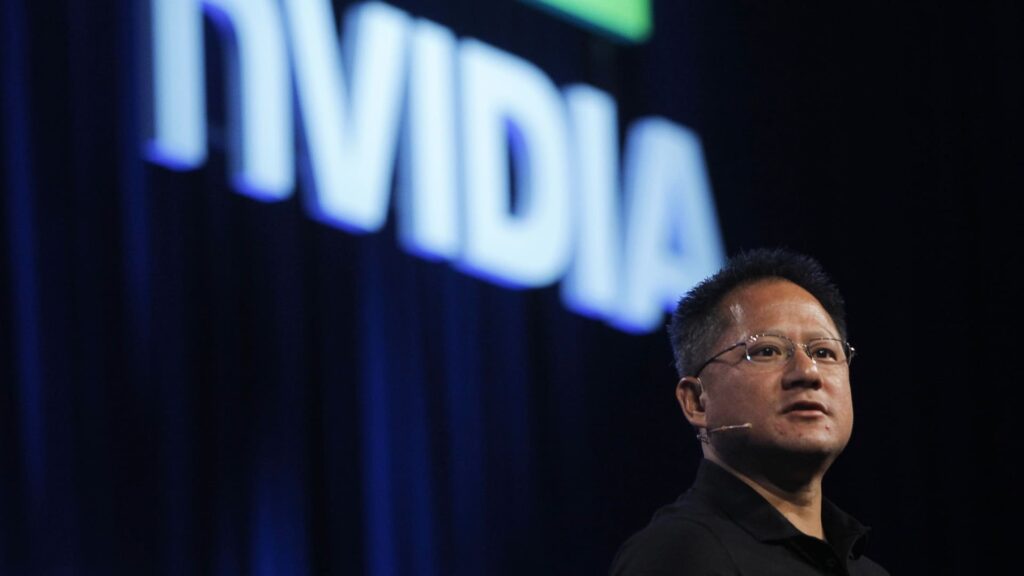

Morgan Stanley has named some of the stocks best positioned heading into 2026. Wall Street investment banks said companies like Nvidia are top candidates for next year. Other Overweight rated companies reviewed by CNBC Pro include Western Digital, Spotify, and Palo Alto Networks. Morgan Stanley said Spotify is firing on all cylinders. Analyst Benjamin Swinburne said audio streamers and podcast platforms have a unique combination of AI usage and positive growth. “The risks of AI to music labels have already been downplayed, and we see an opportunity to reposition AI as a tailwind,” he added. Swinburne believes Spotify has a number of tools at its disposal to drive profit growth, including pricing power. “While we expect Spotify to absorb the lowest cost of content per subscriber increase in 2026, likely starting at least in January, we believe it can benefit from other factors to drive sufficient (average revenue per subscriber) growth and achieve our and consensus gross margin expansion expectations,” he wrote. The company’s stock price will rise 30% in 2025. Palo Alto Networks analyst Meta Marshall lists cybersecurity providers as the best idea for 2026. Morgan Stanley recently raised its price target to $245 per share from $228, saying the stock’s current price is too attractive to ignore. Marshall likes Palo Alto’s growth prospects and is bullish on the pending acquisition of CyberArk. “We originally made PANW a Top Pick in September because we thought the company was best positioned to benefit from the platformization and AI trends, especially given its valuation, and all of that still holds true,” she wrote. Meanwhile, the company’s stock price will rise by 3.6% in 2025. “We continue to like the stock’s pricing as CY26 progresses and believe there is still significant upside to performance this year as backend loads increase, acquisition completions/integrations increase, and AI tailwinds strengthen,” the analyst said. The bank said hard disk drive (HDD) data storage company Western Digital is also firing on all cylinders. Analyst Eric Woodring said in a recent note that Western Digital has multiple catalysts in store, including the company’s Innovation Bazaar, Investor Day and quarterly results early next year. “HDDs continue to be one of the healthiest end markets in our technology hardware space, with customer demand gradually improving,” Woodring wrote. The investment bank also raised its price target on the stock from $188 to $228 per share, citing the stock’s solid exposure to cloud capital spending. “WDC remains our top pick, with the most attractive combination of end market strength, pricing power and near-term catalyst,” Woodring said. The stock price quadrupled in 2025, soaring more than 302%. Nvidia “remains the core of the AI industry, and we think it’s hard to look at other areas of AI at low-demand multiples. Nvidia continues to perform at a very high level, exceeding sales by $10 billion in October ($3 billion above expectations) and on track to add another $8 billion in January. With hundreds of billions of unmet demands (and uplifts) yet, AI “We expect the stock to rise as sentiment stabilizes for Spotify” “AI risk to music labels has already been discounted, and we see an opportunity to reposition AI as a tailwind.” We expect SPOT to absorb the minimum cost of content per subscriber increase in 2026, likely starting in January at least for WMG, but with sufficient ARPU. Palo Alto Networks “We first made PANW a top pick in September because we believe it is best positioned to benefit from the platformization and AI trends, especially given its valuation. All of that remains true. We believe there is still significant upside to performance as CY26 progresses as backend loads increase throughout the year, acquisitions close/integrate, and AI provides stronger tailwinds.” Western Digital “Going into next year, we have an OW bias towards companies exposed to the strengths of (1) Cloud CapEx/Public Cloud Spending – WDC/STX/SNX. … HDD continues to be one of the healthiest end markets covered in our technology hardware universe, and customer demand is gradually improving.”