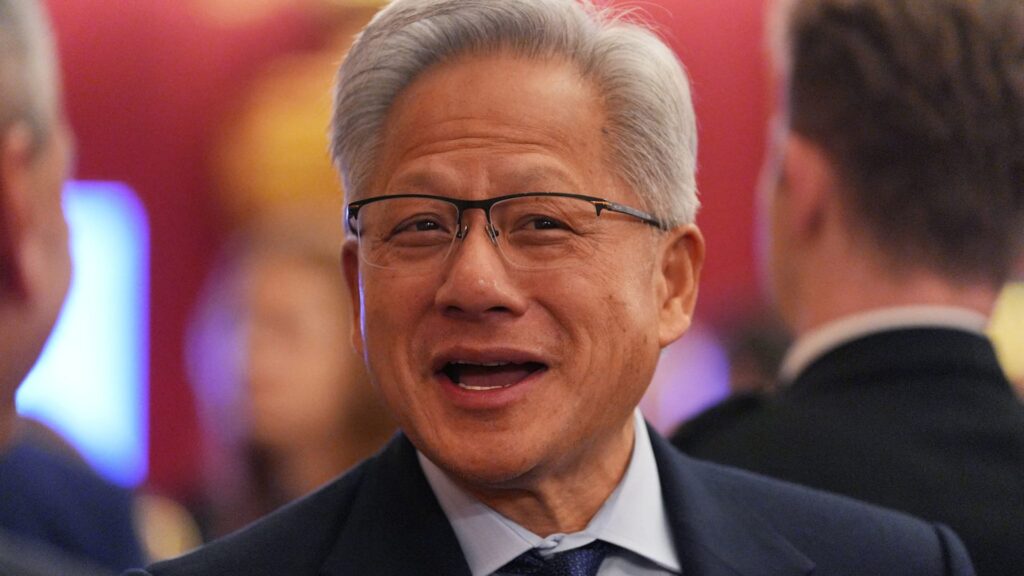

My Top 10 Things to Watch Tuesday, December 9th 1. Stocks were little changed this morning after yesterday’s down session. Traders are awaiting the Fed’s next interest rate decision on Wednesday afternoon. According to the CME FedWatch tool, the market has priced in 89% odds of a 25 basis point (bp) cut. This is the third rate cut this year. 2. President Donald Trump said club name Nvidia could ship H200 AI chips to certain customers in China in exchange for a 25% cut to the U.S. government. Wells Fargo analysts called this an “incremental positive.” The company’s stock rose 1% early this morning. The big question is: Will Chinese customers actually buy the chips? 3. Goldman Sachs initiated Danaher with a buy and price target of $265. Analysts expect large-cap life sciences stocks to return to growth, but remain cautious about recovery in end markets such as drug discovery. Danaher is a large but underperforming biotechnology and life sciences company owned by a trust. However, analysts also like competitors Agilent and Thermo Fisher Scientific, weakening Goldman’s recommendation. I talked about this dynamic last week on “Mad Money.” 4. PepsiCo reached an agreement with activist investor group Elliott Investment Management to lower costs and prices. Elliott revealed his $4 billion stake in PepsiCo in September. The question is, will it matter next year, given that GLP-1 weight loss drugs from club name Eli Lilly and peer Novo Nordisk are likely to be targeted next year? 5. Wolfe Research upgraded Eaton from Hold to Buy. Analysts maintained their $413 price target and expect 2026 to be a good year for the company’s electricity backlog conversion. This is not only one of our data center businesses, but also probably the most important power equipment company in the AI food chain. Industrial stocks rose 1.5%. Yesterday, Deutsche Bank named Eaton one of its top picks in 2026. 6. City lowered its price target on club name Nike from $74 to $70, keeping it unchanged ahead of next week’s fiscal 2026 second-quarter results. Analysts expect the footwear giant to outperform, but expect an underwhelming sales outlook for the fiscal third quarter. Nike is undergoing a rebuilding period, and I believe in CEO Elliott Hill’s vision to restore the iconic brand. Last week we reported on a shake-up of senior leadership. 7. Goldman Sachs upgraded Viking from Hold to Buy and raised its price target from $66 to $78. Analysts said the cruise line is differentiated from other cruise lines. I agree. Goldman downgraded Norwegian Cruise Line from buy to hold and cut PT by $2 to $21, citing too much capacity in the Caribbean. Analysts also downgraded Royal Caribbean PT from $334 to $275, but maintained a Buy rating, arguing that 2026 will be a transition year. 8. Stifel lowered Adobe’s price target from $480 to $450 ahead of the company’s fourth-quarter results later tomorrow. Analysts, who maintained a buy rating on the stock, said it was “no secret” that the stock’s overhang told the story of artificial intelligence hurting the creative sector. 9. Home Depot provided cautious guidance this morning at its 2025 Investor and Analyst Conference. No wonder home builder Toll Brothers offers the same thing. The club’s name, Home Depot, relies on homes stuck because mortgage rates remain too high. The Fed needs to cut rates. 10. Stifel analysts suggested that speculation that Marvell Technology will lose Amazon as a custom chip customer is “unfounded.” The firm maintained a Buy rating on Marvell stock, which rebounded slightly this morning after falling 7% yesterday. Stifel also expressed doubts about reports that Microsoft is considering a move to Broadcom. Analysts did not mention the companies by name in a note outlining the incident. Sign up for free for my Top 10 Morning Thoughts on the Markets email newsletter (See here for a complete list of Jim Cramer Charitable Trust stocks, including NVDA, DHR, ETN, NKE, AMZN, MSFT, AVGO.) As a subscriber to Jim Cramer’s CNBC Investment Club, you’ll receive trade alerts before Jim makes a trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in his charitable trust’s portfolio. If Jim talks about a stock on CNBC TV, he will issue a trade alert and then wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.