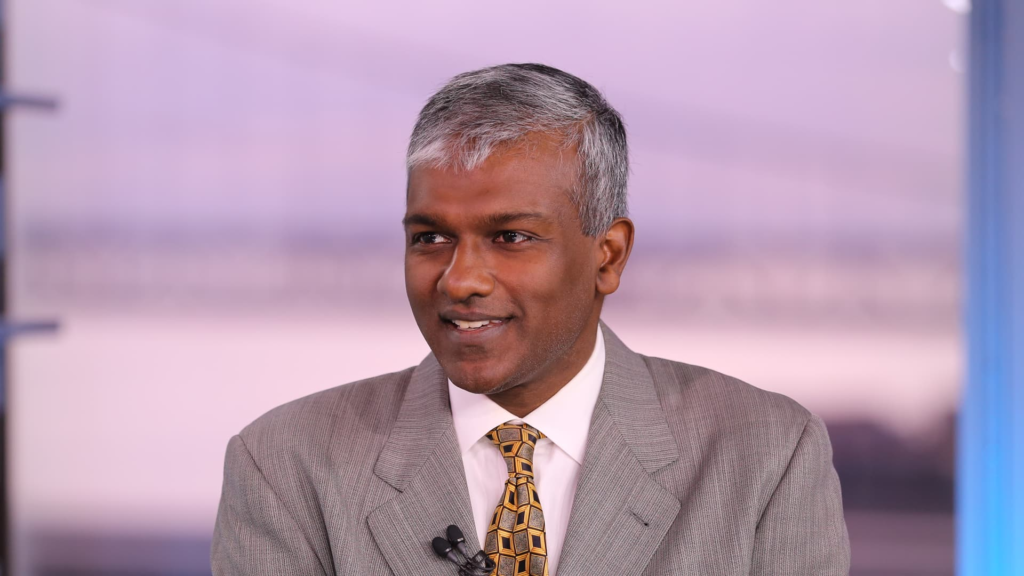

Investor Dan Niles has named Cisco Systems and Apple as his top stocks heading into 2026. The founder and portfolio manager of Niles Investment Management appeared on CNBC’s “Money Movers” on Wednesday to share his top five stocks heading into the new year. Niles highlighted Cisco as the only stock he repeated from last year’s list of favorites. Niles praised the stock as a way for investors to “keep riding the AI wave.” He added that AI-related revenue from major hyperscalers has boosted Cisco’s revenue from an average growth of 1% over five years to as much as 5% in fiscal 2025. Niles believes this growth could accelerate to high single digits. “They have these new products with silicon, and one of them should come out and help them participate in building this growing AI infrastructure, because they’re going to need to network these AI data centers. And companies are going to need to start upgrading their networks as the AI data starts flowing,” he said. Cisco’s stock price will rise more than 30% in 2025. Niles also named Apple, the giant of the Magnificent Seven, as one of the top candidates. He cited iPhone manufacturers’ form factor changes and AI-powered Siri as future drivers. “I can have an AI-enabled flip phone. It might actually turn out to be a good thing that they’re years behind on AI, because they can tap into some of these more marginal players that they might actually need to collaborate with,” Niles said. Apple had a lackluster 2025, rising 9% for the year while the S&P 500 index rose about 17%. .SPX AAPL YTD 2025 Mountain AAPL vs. SPX Other top stocks included Impinj, which makes radio frequency identification devices (RFID). Grocery retailers like Kroger and Walmart are starting to implement this technology, presenting a huge opportunity. “Today’s major market for RFID chips is apparel, which sells about 80 billion chips a year. The food market will exceed 1 trillion chips,” Niles said. Niles also listed Boeing as a top stock. He highlighted that aircraft manufacturers’ backlog is increasing and currently stands at $600 billion. Other long-term tailwinds include increased defense spending, including from the proposed Golden Dome missile defense project. Niles also cited Nike. The apparel giant rose 5% on Wednesday after insiders, including CEO Elliott Hill and Apple CEO and Nike board member Tim Cook, disclosed stock purchases. Niles said he was confident Hill could successfully lead Nike’s turnaround story. A veteran of the company, he returned from retirement to take the helm late last year. “Elliott Hill is a 32-year veteran of Nike. He is returning to Nike’s roots with a focus on sports distribution and innovation,” Niles said. Nike’s stock price fell 15% in 2025.