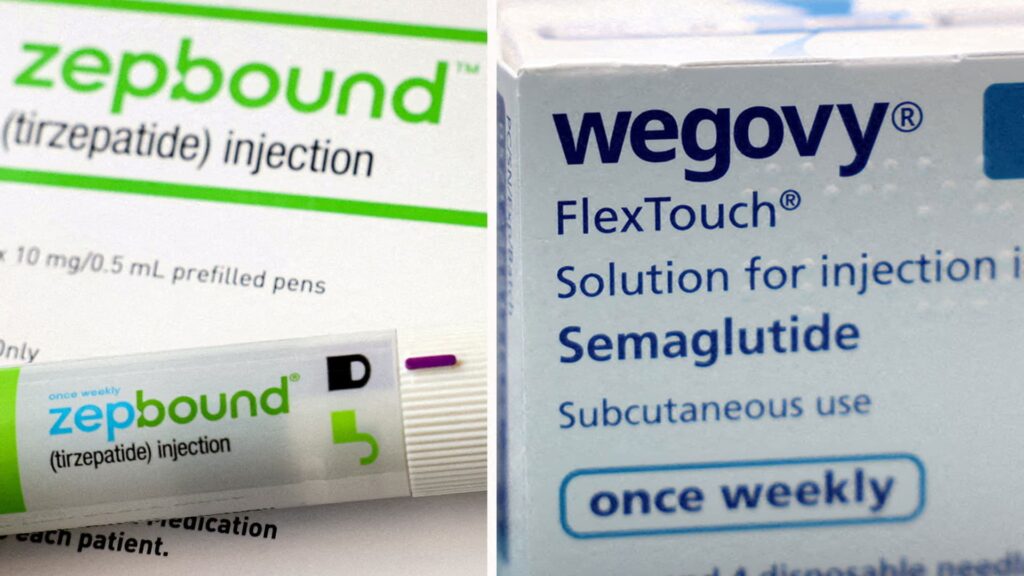

The combined images show Zepbound infusion pen, Eli Lilly’s weight loss pills, and a box of Wegovy made by Novo Nordisk.

Holly Adams | Reuters

New trial data suggest that the edge of Novo Nordisk’s weight loss drug Wegovy will shut out rival treatments for reducing the risk of heart condition as Danish Pharma Giant is fighting challenges in major US markets.

The company said on Sunday that the ongoing use of semaglutide, a weight-controlling drug sold to consumers as Wegovy, reduced the risk of heart attacks, strokes, or death in people with obese, cardiovascular disease, or overweight people by 57%.

Tilzepatido is the active ingredient in Zepbound and Munjaro manufactured by US company Elirily and is Novonordisk’s major rival in the fight to produce market-leading weight management treatments.

The company noted that the results came from real-world studies in contrast to randomized controlled trials, which are the “gold standard” for assessing treatment effectiveness. The number of patients recording such events was also very low, reaching 0.1% of patients using Wegovy and 0.4% of patients with tilzepatide.

However, the company said, “There is growing evidence suggesting that the cardioprotection benefits seen in Wegovy are unique to semaglutide molecules and therefore cannot be extended to other GLP-1 or GIP/GLP-1-based therapies.”

GLP-1, or glucagon-like peptide-1 receptor agonists, refer to the range of drugs used to treat type 2 diabetes and obesity by mimicking hormones produced in the intestine to suppress human appetite and regulate blood glucose levels. This includes Novo Nordisk’s famous semaglutide-based Ozempic, designed to treat type 2 diabetes.

The huge growth in weight loss drug use in recent years has been fascinated by investors with the ongoing hunt of both major drugs and potential new challengers.

From heart disease, liver, and Alzheimer’s disease to sleep apnea and alcoholism, test data on the effects of various drugs on weight loss and various other conditions often catalyze stock price movements. Traders have recently evaluated efforts by Eli Lily and Novo Nordisk to develop oral tablets for obesity, eliminating the need for injections.

Novo Nordisk’s shares rose about 3% on Monday.

Morningstar’s chief equity strategist Michael Field said the significant reduction in the risk of heart attacks offered by Wegovy could be a potential “game changer” for Novo Nordisk, but Monday’s response showed the market was “encouraged, but not engrossed.”

“It’s important to remember that this is mere trial data and rivals have a long history of overtaking each other once again. It specifically prevents investors from being thwarted by the largest traditional pharma giants.

Sheena Berry, healthcare analyst at Kilter Ceviot, said the latest cardiac data could be “positive developments” for Novo Nordisk, but “we cannot draw solid conclusions on the comparison between Vegovi and Tilzepatide in the battle between Novo Nordisk and Eli Lily.”

“However, following a tough period, it helps Novo Nordisk in terms of promotion. As a result, after a difficult period, stocks are increasing today and investors are closely watching whether such events will serve as a catalyst for improvement,” Berry said in an email.

Novo Nordisk’s US Struggle

The huge success of Wegovy and Ozempic has led Novo Nordisk to the top of Europe’s largest listed company in the second half of 2023, gaining momentum as the company’s expansion in the US.

It then lost its title, following a decline in stock prices of 10.6% in 2024 and 40% in 2025. Denmark last week halved its annual economic growth forecast. This cites in part Novo’s expectations for a decline in US market share and a decline in drug exports.

Novo Nordisk is being wiped out by sector uncertainty over White House tariffs and US President Donald Trump’s push, calling for businesses to lower drug prices and move manufacturing nations. Global competition in the weight loss space continues to grow, and businesses are also facing challenges with imitation therapy.

NOVO reported a significant increase in annual revenue in second quarter revenues, but it still flagged its second half sales growth forecast for the US is weak and said it will focus on consumer sales to combat the challenges of copycat.

Denmark last week cut its annual economic growth forecast by halving. The country’s economy ministry said companies such as Novo Nordisk are now making tariff rates clearer following the EU-US trade agreement, but there remains a “slight degree of unpredictability associated with the policies of the US administration.”

Analysts told CNBC last month that European pharmaceutical stocks failed to meet news of trade contracts as investors remained wary of the White House’s ongoing Section 232 investigation into the impact of various imports on US national security, including drugs.

In a memo last week, UBS analysts said they are “starting to see potential plateaus of potential plateaus” of drugs following a May move by the US drugstore chain CVS to expand access to Wegovy. It “aligned with previous expectations given the continued presence of Compatina and the relatively strong performance of Zepbound,” they added.

-CNBC’s Karen Gilchrist contributed to this story.