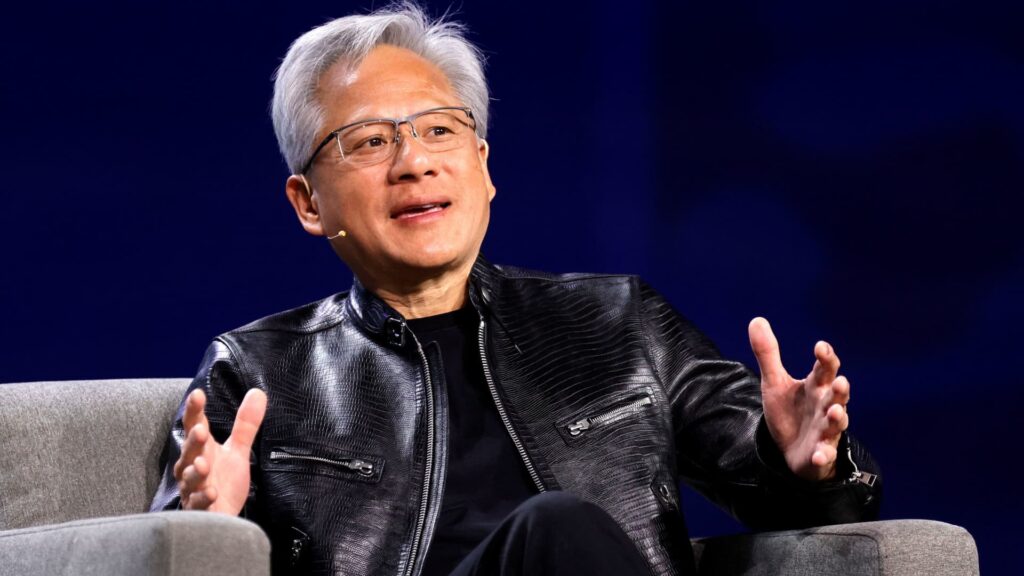

Please wait a second. It only takes a second. Before you sell everything related to artificial intelligence, think back to a little over a year ago. January 27, 2025 was “Black Monday” for the technology industry. That’s when Chinese startup DeepSeek shocked the market with a competitive AI model it claimed was trained at a fraction of the cost of top American models. Nvidia stock lost about $600 billion in market value in one day. By the time the turmoil was over, Nvidia had plummeted from about $143 per share on Friday, January 24th, to the low $90s, a weary decline that lasted until April 2025, when it became clear that Deep Seek was all smoke and mirrors and that the U.S.-China trade tensions that had been hurting the stock were beginning to turn a corner. Just a side note that Alibaba just released a new multimodal version of its AI model Qwen, which can understand text, photos, and videos. This is what I saw Nvidia’s chip do at the annual GTC conference last March. Additionally, there will be another DeepSeek release shortly after. You can rest assured that the press won’t talk about how good Nvidia’s chips are, instead claiming that Alibaba uses much cheaper silicon and is better. In fact, that’s to be expected. But something else strange is happening. Shares in Dassault and Siemens were jolted on Monday by reports that the Swiss elevator maker Schindler has dropped its “digital twin” partner (it’s unclear which one) as it pursues artificial intelligence alone. Digital twin refers to a common method of building a “digital” version of infrastructure prior to large-scale construction. Dassault had been Schindler’s partner for a very long time, but it is presumed that Dassault was fired. “Schindler is an active customer,” a spokesperson for the French 3D design software company told Bloomberg News. Nevertheless, Dassault shares fell 10% on Monday after just a few sessions after announcing light guidance along with earnings, raising concerns that “AI will eat the software.” Meanwhile, Siemens fell 6.4% on Monday. On Wall Street on Tuesday, I think every infrastructure company that creates digital twins deserves to be kicked out, both those that actually use digital twins and those that don’t. Nvidia will most likely also be disposed of, as the AI used by Schindler is likely based on Nvidia’s platform. No one else has the intellectual property to do so, so I don’t see why it wouldn’t happen. Why does such a thing happen? Crimes by association. Just a few weeks ago, Dassault CEO Pascal Daloz and Nvidia’s Jensen Huang appeared on “Mad Money” to talk about how well their partnership is working. Again, the conspirators will say that if Dassault is gone, so is Nvidia. It makes it seem like Schindler developed his own AI chip, but that’s clearly not the case. Does it matter? Wait, there’s more?As of Thursday night, when we received Applied Materials’ earnings report, we had received reports from all three semiconductor capital equipment companies. All three are sold out. Assigning. We know that memory companies like Micron, SanDisk, Seagate, and Western Digital are selling out and prices are increasing significantly. In some cases, memory prices can increase by 600% in a year. A shocking call from Cisco about DRAM shortages hurting its bottom line, at least to this portfolio manager, sent the company’s stock plummeting and put a lid on technology, especially Nvidia. why? Because it’s supply and demand. Tight supply and high prices will lead to demand destruction, and demand destruction will crush Nvidia’s sales. Well, we have to ask ourselves. Are we going to let what happened a year ago happen again? Can we step aside and come back? Are you planning to sell and sell short? This doesn’t allow us to own it, right? Especially with that awful head and shoulders graph. The answer, of course, is us. It is written. My point is, how did we at the club know that millionaires would be born from among those who stayed the course? I didn’t. But we had faith. Keep the faith. That’s my husband. Surviving a repeat of last year will require effort on all fronts. (Jim Cramer’s charitable trusts are long NVDA and CSCO. See here for a complete list of stocks.) As a subscriber to Jim Cramer’s CNBC Investment Club, you will receive trade alerts before Jim makes a trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in his charitable trust’s portfolio. If Jim talks about a stock on CNBC TV, he will issue a trade alert and then wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.