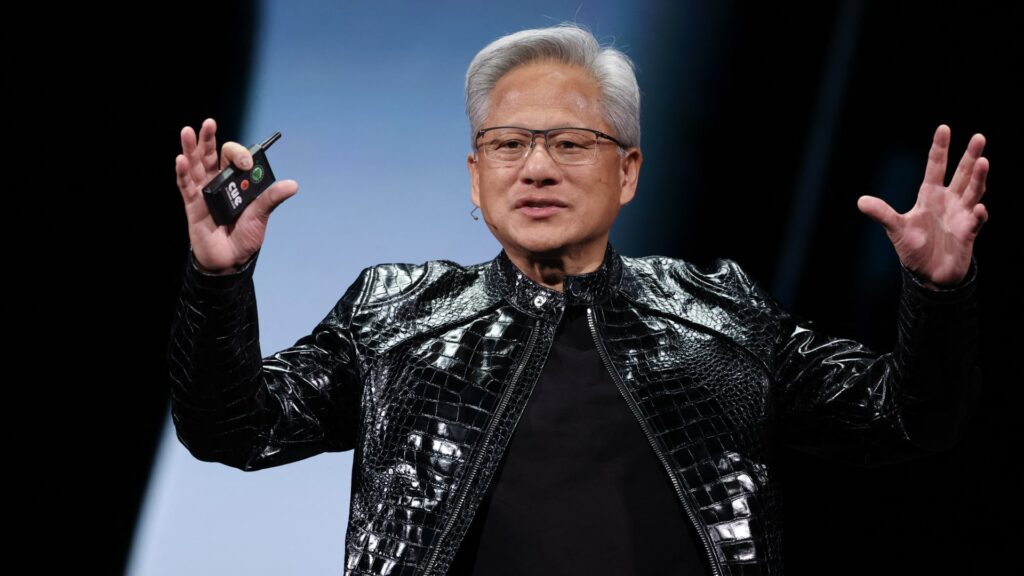

As they say, being dark isn’t the only thing policed. I’m talking about “Mad Money” being taken off the air in recent weeks in time for the Winter Olympics. On the regular Friday edition of the show, we’ll be explaining our game plan for next week, so let’s do it here. “Mad Money” is Monday, a light day on the calendar. But I’m obviously sensitive about tensions in the Middle East and what President Donald Trump might do with Iran. This conflict is entirely about regime change. The president appears to believe that Iran has been free-riding on whatever it wants with nuclear power, and that it is time to teach the country a lesson that successive administrations have rejected. That would be a hopelessly unstable situation, but we recently raised some capital and are excited to put it to use in some of our favorite companies. Alphabet is a position I would like to build on now that I have reduced exposure to some stocks that I believe do not meet our criteria. Oil enthusiasts may want to consider Diamondback Energy. I don’t stress about oil. We did not expect the sudden spike caused by the US-Iran conflict. Crude oil prices hovered around six-month highs on Friday, marking the first weekly increase in three years. Tuesday is big. Let’s start with Home Depot’s quarterly results. Home Depot locations have become hotbeds for ICE arrests due to constant roundups of immigrants seeking work. Chasing Hispanic people will not help your Hispanic customers. It could be a difficult quarter, but our biggest fear is that interest rates will fall, which is what will happen when Kevin Warsh takes over as the new head of the Federal Reserve in mid-2026. I’m not really concerned about actual same-store sales. After Tuesday’s close, one of the most important enterprise software data points was released: Workday’s earnings report. First, a little background. The biggest battleground in this entire market right now is artificial intelligence eating software. In this case, agents, especially those made by Anthropic, are thought to be able to reduce the number of seats their clients pay. Anthropic is thought to be able to avoid what Workday is doing with HR and finance. Aside from the fact that Anthropic is said to actually be a Workday customer. The company suffered from a not-so-strong last quarter that prompted the return of Anil Bhosri and the departure of Karl Eschenbach, who was considered the next best CEO by Wall Street. I have known Busri for many years. He’s amazing. Salesforce CEO Marc Benioff has been a great spokesperson for the power of Agentforce, but his SaaS (Software-as-a-Service) business appears to be hurting by seat count declines. If there’s anyone who can tell people honest stories about SaaS and AI and how they can coexist, it’s Bhusri. Wednesday is one of those days known as “fulcrum” days, and things may never be the same after Wednesday. That’s because Nvidia is reporting, and investors and analysts know all about how much money Nvidia is making, and how much they’re benefiting just from the hyperscalers. I would like to ask about demand. I would like to ask about the roadmap. I hear about out-of-memory gate elements. If Nvidia does well, we’ll see some monster moves in the technology space that reaffirm its position as a market leader. I strongly believe that we should own Nvidia, but I know there are many people who don’t believe that semiconductor companies should be the largest in the world. I beg to differ. Club stock Nvidia is at the center of the Fourth Industrial Revolution and remains a blue-chip customer even though Alphabet and Amazon have developed their own chips. Meta Platforms is a very good customer. Quarter games are not played. I’m thinking of playing the long game. That means considering how valuable Nvidia’s chips are from a total cost of ownership (TCO) perspective. Salesforce also reported on Wednesday that the club’s stock has plummeted. This is one of the worst stocks in the S&P 500, but that’s not because the company underperformed expectations. That’s because people don’t believe in revenue and the “old” Salesforce will be killed off by AI agents. At 15 times forward earnings estimates, the bottom may be in sight. But after seeing multiple compressions for over a year, I’m insane. Patience was not rewarded. Moreover, every time Anthropic introduces a new AI tool designed for enterprises, cybersecurity, HR, etc., the software sector languishes. I’m sure Mark will stand up to the bears head on. I don’t know if that matters. There are also important stock reports on Wednesday mornings. TJX will tell you the numbers. Last quarter was so strong that the stock price skyrocketed. This disrupted the consistent pattern of stock prices rising before the market opens and then crashing. We expect this to be another big quarter. TJX trades on how much closeout product it can get. There are a lot of them now. Great setup. Home Depot and Lowe’s are typically evenly matched. Lowe’s currently has the lead and we expect it to report better numbers than Home Depot. However, Home Depot has built a significant presence in the professional home builder segment, which is having an impact as interest rates fall. On Thursday, one of the biggest winners, Qnity Electronics, reported. This is a materials business spun out of DuPont with a focus on semiconductors. It’s the best market in the world. The company’s stock price has been going absolutely parabolically, so I decided to take it a little lower on Friday. I just want it to be the right size. It might not matter because I ran so much, but I’m hoping for good numbers. After the close on Thursday, CoreWeave, Nvidia’s partner in building data centers, will report and provide clarity on its performance. Although the stock price has fallen significantly, it is still twice what it was when it went public in March 2025. This stock is being contested between bears and bulls. A complete battlefield. You know I don’t like battlefields. CoreWeave knows how to run a data center better than any other company. If Nvidia has a great report, this will be noticed. Dell Technologies also reports that this company is better in the rack and personal computer business, arguably better than Hewlett Packard. However, there are major concerns that rising memory prices will slow sales. I don’t like betting on Michael Dell. Finally, there’s the conundrum: Intuit. It is also being attacked by AI agents. I often hear that there are better agents than the software provided by Intuit. I would like to see a product that is comparable to this excellent company’s product. Intuit has penetrated many small businesses. I look at it as a survivor. However, I don’t know if anyone would pay more than that. It’s an important week. No stock is more important to this market than Nvidia, but the decline and potential decline of software may be the theme that captures most of the market’s mindshare. (See here for a complete list of Jim Cramer Charitable Trust stocks.) As a subscriber to Jim Cramer’s CNBC Investment Club, you will receive trade alerts before Jim makes a trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in his charitable trust’s portfolio. If Jim discusses a stock on CNBC, he will issue a trade alert and then wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.