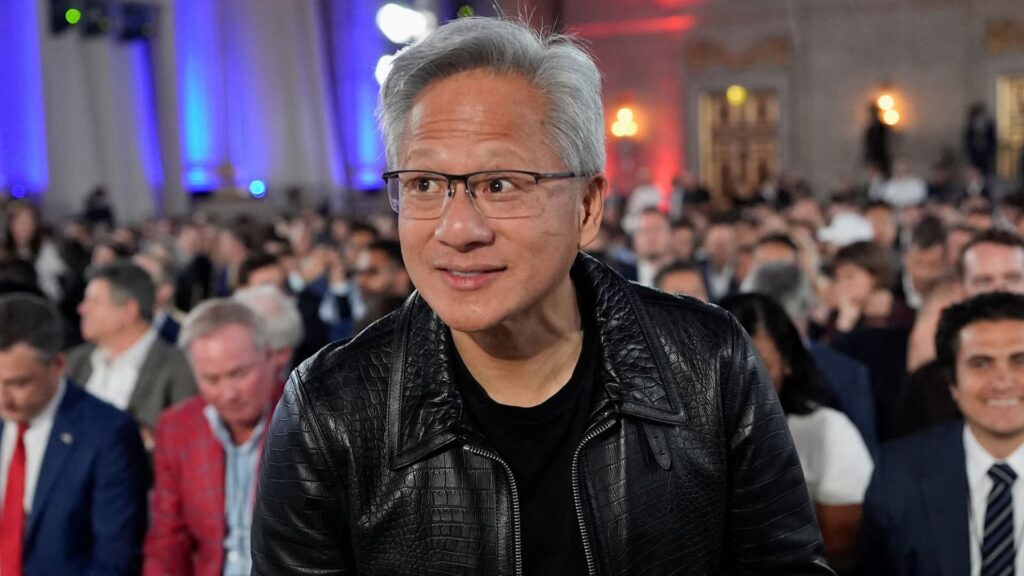

Jensen Huang, co-founder and CEO of Nvidia Corp., will be attending the 9th edition of the Vivedch Trade Show, held in Paris on June 11, 2025.

chesnot |Getty Images Entertainment |Getty Images

nvidia CNBC has just fired over $900 million to hire Enfabrica CEO Rochan Sankar and other employees at an artificial intelligence hardware startup and license the company’s technology.

A transaction that reminds us of the recent acquisition of AI talent Meta and GoogleNvidia is paying cash and shares in the transaction, according to two people familiar with the arrangement. The deal ended last week, with Enfabrica CEO Rochan Sankar joining Nvidia.

Nvidia served as the backbone of the AI boom that began with Openai’s ChatGPT launch in late 2022. This is generally purchased in large clusters, allowing for large cloud providers to enhance training of large language models and provide AI services to clients.

Founded in 2019, Enfabrica says its technology can connect over 100,000 GPUs together. This is a solution that helps nvidia provide integrated systems around the chip, so the cluster can effectively function as a single computer.

An Nvidia spokesman declined to comment, and Enfabrica did not provide a comment on the story.

Nvidia’s previous AI chips like the A100 had single processors slotted into servers, but their latest product is in a tall rack installed to work with 72 GPUs. It’s a type of system within a $4 billion data center in Wisconsin Microsoft It was announced on Thursday.

Nvidia had previously invested in Enfabrica as part of the $125 million Series B round in 2023 led by Atreides Management. The company did not disclose its valuation at the time, but said it was a five-fold increase from Series A funding.

At the end of last year, Enfabrica was launched in Spark Capital, Arm, Samsung, and Cisco. According to Pitchbook, the post-money valuation was around $600 million.

High-tech Giants Meta, Google, Microsoft and Amazon Through a transaction similar to Acquihire, all of your money was poured into hiring AI talent. The deal allows companies to bring in top engineers and researchers without worrying about the hassle of the regulations associated with acquisitions.

The biggest such deal came in June when Meta spent $14.3 billion on Scale founder Alexandr Wang and took a 49% stake in AI startups. A month later, Google announced an agreement to introduce Varun Mohan, co-founder and CEO of artificial intelligence coding startup Windsurf, as well as other research and development employees, in a $2.4 billion transaction, including licensing fees.

Last year, Google signed a similar agreement to introduce the founder of Character.ai. Microsoft did the same thing for inflection, just like Adept’s Amazon.

NVIDIA was a large investor in AI technology and infrastructure, but it was not a significant acquirer. The company’s billions and more than billions of dollars were the only deals for Israeli chip designer Mellanox, a $6.9 billion purchase announced in 2019. Much of Nvidia’s current Blackwell product lineup is enabled by the networking technology acquired through its acquisition.

Nvidia tried to buy Chip Design Company armHowever, the deal collapsed in 2022 due to regulatory pressure. Over the past year, Nvidia has closed its $700 million Run purchases. AI, AI is an Israeli company that helps software makers optimize their AI infrastructure.

On Thursday, Nvidia announced one of its biggest investments to date. The chipmaker said it needed $5 billion in stock Intelannounced that two companies will work together on AI processors. Nvidia said this week it invested nearly $700 million in UK data centre startup NSCALE.

– Fix: Previous versions of this story incorrectly included the name of the company as an investor in Enfabrica.

Watch: Nvidia CEO says he’s happy to work with Intel