jpmorgan chain CEO Jamie Dimon said a Labor Department report released Tuesday confirmed that the US economy was slowing.

The department reduced non-farm pay data data for the year ending March 2025, with 911,000 jobs from the initial estimate. It was the high side of Wall Street’s expectations for a downward shift and biggest revision over 20 years.

“I think the economy is weakening,” Dimon said. “I don’t know whether it’s heading into a recession or just weakening.”

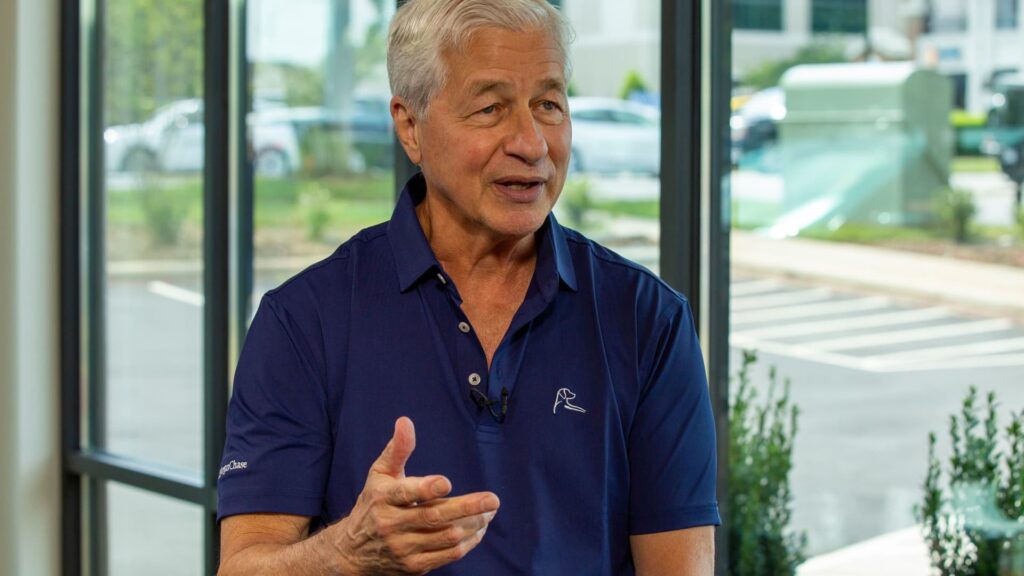

JPMorgan Chase CEO Jamie Dimon speaks with CNBC’s Leslie Picker on July 31, 2025 in Charlotte, North Carolina.

David A. Grogan | CNBC

The revision, which shows that the world’s largest economy produces far fewer jobs than thought, follows a report showing that job growth almost halted in July, adding just 73,000 jobs. President Donald Trump fired the Director of Labor Statistics last month hours after the release of the report.

The August figures showed weakness as non-farm salaries only increased 22,000 that month.

Investors pay attention to Dimon’s views on the economy given his long tenure, leading the largest US bank by assets through periods of turbulence. Still, he often warns of risks that don’t come to fruition anytime soon.

Dimon said JPMorgan knows a variety of data on consumers, businesses and global trade. Most consumers are still working and spending money according to their income level, but their confidence may have just been a hit.

“There are many different factors in the economy right now,” Dimon said, citing weaker consumers and still robust corporate profits. “We just have to wait and see.”

The Federal Reserve “probably” will “reduce” benchmark interest rates at its next meeting later this month, “it’s not a consequence for the economy,” Dimon said.