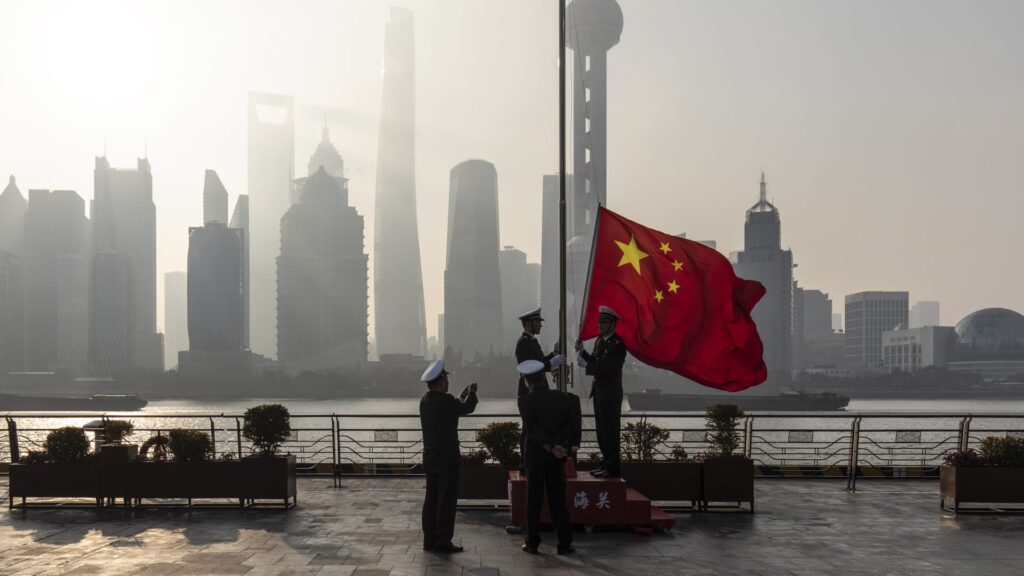

Chinese customs officials are raising the Chinese flag during rehearsals for a flag-raising ceremony in Shanghai.

Qilai Shen | Bloomberg | Getty Images

The Asia-Pacific market was mixed on Monday as investors assessed China’s rating dog manufacturing data in August. The metric is now 50.5 compared to the previous month’s contraction of 49.5.

Data released on Sunday showed that PMI data from the country’s manufacturing industry came to 49.4 in August compared to the previous month’s 49.3.

Investors are also evaluating the development of India-China relations after leaders from both countries agreed that they were development partners rather than rivals during a two-day meeting of the Shanghai Cooperation Agency’s Regional Security Block. In his opening remarks at the summit, Chinese President Xi Jinping urged SCO members to strengthen their cooperation with artificial intelligence, rejecting what they call “the Cold War mentality.”

Hong Kong’s Hangsen index rose 2.17% to 25,617.42, Alibaba GroupCSPC Pharmaceutical Group jumped 18.58%, 9.53%, and Wuxi Biologics wined 8.37%.

Meanwhile, mainland China’s CSI 300 closed at 4,523.71, rising 0.6% in choppy trade.

In Japan, the Nikkei 225 analyzed the losses, with 1.24% lower at 42,188.79. The losses were led by semiconductor manufacturers advantage7.92% Disco Corp7.71% declined socionexta 6.32% decrease.

Meanwhile, Japan’s wider Topix index fell 0.39% to 3,063.19.

In Korea, the Kospi index fell 1.35% to close the day at 3,142.93, while the small Kosdaq lost 1.49% at 785.

Australia’s S&P/ASX 200 benchmark retreated from 0.51% to 8,927.70.

In India, the benchmark Nifty 50 added 0.66%, while the BSE Sensex index rose 0.6% as of 1:35pm (4:05am ET) standard time in India.

Investors were also evaluating the U.S. President Donald Trump’s decision to “mutual tariffs are illegal.”

The U.S. Federal Circuit Court of Appeals ruled on Friday that Trump has stepped over the authority of the president by imposing taxes on almost every country in the world as part of the announcement of its “liberation date” on April 2.

On Wall Street, stock prices fell on Friday, as new inflation data showed prices were a risk that prices are still heading for a new month.

Broadbase S&P 500 It ended the day 0.64% lower at 6,460.26, but still won its fourth championship month. The NASDAQ Composite fell 1.15% to finish at 21,455.55, but the Dow Jones industrial average lost 92.02 points (0.20%) and settled at 45,544.88.

The US market is closed on Monday due to Labor Day public holidays.

-CNBC’s Sean Conlon and Brian Evans contributed to this report.