(This is Warren Buffett Watch newsletter, news, and analysis. Everything about Warren Buffett. You can sign up to receive it in your inbox every Friday evening.)

Berkshire will completely close profitable stocks of Chinese EV manufacturers

Berkshire Hathaway has completely ended its highly profitable equity investment in Chinese electric car manufacturers byd.

In August 2022, Berkshire began cutting 235 million shares in its $230 million purchase in 2008.

It went to $9 billion following a 41% jump to the value of the position in the second quarter of the year.

By June last year, Berkshire had sold nearly 76% of its shares, resulting in less than 5% of BYD’s outstanding shares.

Below that level, Berkshire no longer needs to disclose subsequent sales under Hong Kong Exchange rules, so as long as it knows the company owns 54 million shares.

However, readers of Buffett Watch noted that a first-quarter financial filing from Berkshire Hathaway Energy, a subsidiary that holds the stock, stated that the investment was zero as of March 31.

A Berkshire spokesman confirmed that the entire BYD position is actually on sale.

Sales continued after stocks fell below 5% last year, based on the investment value listed in the BHE report.

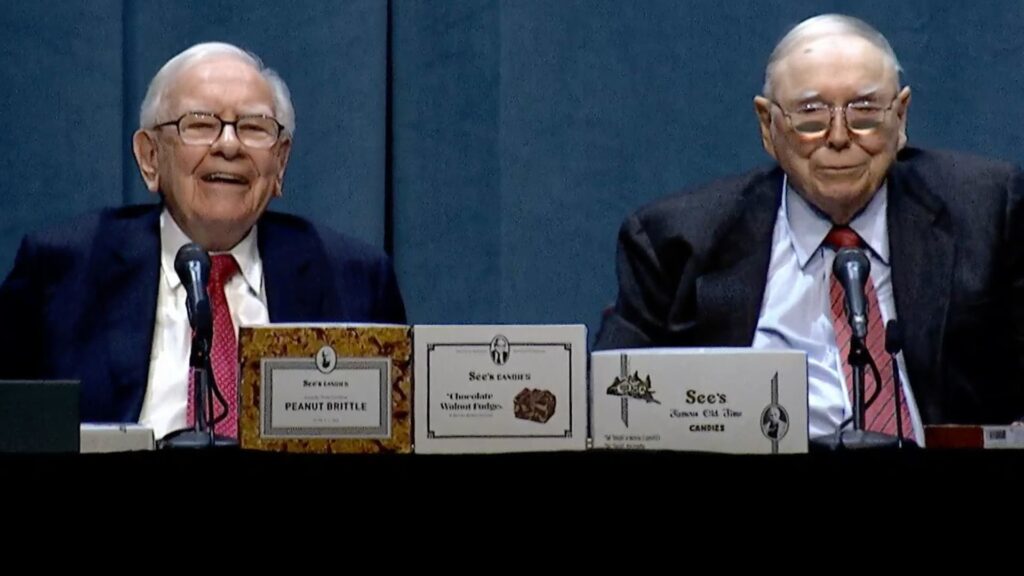

Berkshire made its first purchase 17 years ago, prompted by Charlie Munger.

At the 2009 annual meeting, he told shareholders that he saw the company and its CEO, Wang Chuanghu, as a “damn miracle” despite it appearing “Warren and I were hooked.”

It was an incredible call. BYD shares rose approximately 3,890% in the year that Berkshire owned.

Buffett doesn’t explain in detail why Berkshire started selling, but in 2023 he told CNBC’s Becky Quick that BYD is an “extraordinary company” run by “extraordinary people,” but “I think I’ll find something to do with money that makes me feel good.”

Around the same time, Berkshire sold almost everything in its company. Taiwan SemiconductorsThe stock is about $4 billion in stock, about $4 billion in stock just months after the shares were purchased as it “revaluated” the geopolitical risk posed by Beijing’s claim that Taiwan is part of China. “It’s a dangerous world,” he said.

One thing Trump and Buffett agree

Warren Buffett has not spoken publicly about his general liberal political views in recent years. It could hurt employees and shareholders in 2022, telling shareholders that they would “sustainable madness” and “take it out in our company.”

But it’s reasonable to assume he won’t see his eyes on most issues with President Donald Trump.

But they agree, at least in part, to one thing. US businesses should not pursue very short-term goals.

This week, the president posted about Truth Social that the SEC should allow businesses to report revenues every six months, rather than the current three-month requirement.

“This saves money and allows managers to focus on running the company properly,” he writes.

The SEC tells CNBC that it is “prioritizing this proposal to further eliminate unnecessary regulatory burdens for businesses.”

Buffett, who has made famous for making decisions in the long run, has urged businesses to stop providing quarterly revenue.

Co-authored 2018 Wall Street Journal Opinion Piece jpmorgan chase’s “In our experience, quarterly revenue guidance often leads to an unhealthy focus on short-term profits at the expense of long-term strategy, growth and sustainability,” Jamie Dimon said.

They said it happens when companies cut long-term beneficial spending to meet or beat their short-term forecasts when revenues are affected by external factors that they can’t control.

They argue that “financial markets are too concentrated in the short term” and that quarterly guidance is “a major factor in this trend.”

However, there is an important distinction.

Buffett and Dimon emphasize that they are not opposed to reporting revenues quarterly. They don’t like companies that predict what those revenues are.

They should “continue to provide annual and quarterly reports that look at actual performance retrospectively to ensure that the public, including shareholders and other stakeholders, can appreciate actual progress,” they said.

Buffett around the internet

Some links may require a subscription.

Highlights from the archive

Internet stocks were “a big trap for the general public” (2001)

In the wake of the internet bubble deflation, Warren Buffett saw a “decreased” threat to “deceased” investors.

Berkshire Stock Watch

Berkshire’s US Best Holdings – September 19, 2025

Berkshire Top Holdings is making public stocks publicly available in the US, Japan and Hong Kong by market value based on today’s closing price.

Holdings are as of June 30, 2025, as reported in Berkshire Hathaway’s 13th Floor Submission on August 14, 2025.

A complete list of Holdings and current market values is available from the Berkshire Hathaway Portfolio Tracker at CNBC.com.

Questions and comments

Send questions or comments about the newsletter to alex.crippen@nbcuni.com. (I’m sorry, but I won’t forward any questions or comments to Buffett himself.)

If you haven’t subscribed to this newsletter yet, you can sign up here.

Also, Buffett’s annual letter to shareholders strongly recommends reading. Collected here on the Berkshire website.

– Alex Crippen, Editor, Warren Buffett Watch