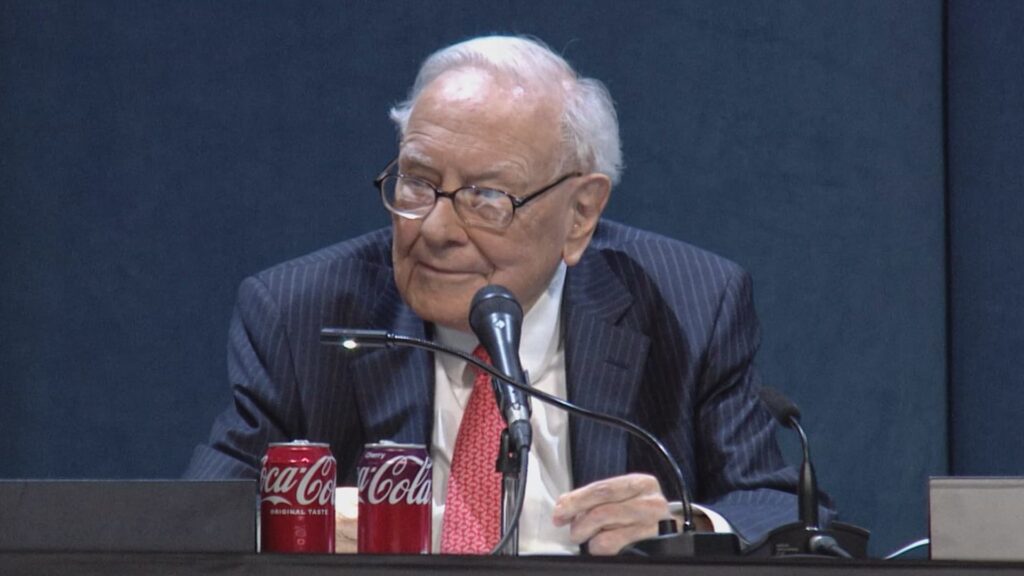

Warren Buffett will speak at the Berkshire Hathaway Annual Shareholders Meeting held in Omaha, Nebraska on May 3, 2025.

CNBC

(This is Warren Buffett Watch newsletter, news, and analysis. Everything about Warren Buffett. You can sign up here and pick it up in your inbox every Friday.)

UnitedHealth Group Since revealing Berkshire Hathaway in mid-August, shares have skyrocketed nearly 30%, claiming that they had purchased more than 5 million shares between April 1st and June 30th.

Minutes before its SEC filing, UNH was closed for $271.49. On Friday, it closed at $352.51.

While UNH had already begun to bounce back from its $237.77 low on August 1, Berkshire’s troubled stock support is at least responsible for a significant portion of its recent profits.

However, it is not clear at this point whether Berkshire’s investments are profitable (on paper).

Current prices have risen by just 13.0% since closing at $311.97 at the end of the second quarter on June 30th.

We don’t know exactly when Berkshire made the purchase in the second quarter, so we can only look at the range of purchase prices.

(And of course, it could have been that they continued their purchases in the third quarter. I don’t know about that until mid-November.)

At a high of $606.36 per share, Berkshire paid $3.1 billion for its shares, turning 42% red.

At a low of $248.88, the 5 million shares cost less than $1.3 billion, earning a 42% profit.

Using the average end of that period, the price is $1.9 billion. Today’s $1.8 billion is worth about 8% below that level.

The Berkshire purchases were probably caused by price slides early in the quarter, so the actual purchase price is probably at the bottom of the range, but despite recent gains in stock, it appears that the stock is likely to be red.

A sign for UnitedHealth Group Inc. on the floor of the New York Stock Exchange on April 21, 2025.

Michael Nuggle | Bloomberg | Getty Images

However, Berkshire & Company has usually been there for a long time. There are also some bullish signs in the stock, which is still down 30%.

Analysts at Morgan Stanley said after meeting with UNH management, “I am gradually positive following discussion with UNH (management), who was convicted of turnarounds.”

On Friday, Morgan Stanley’s Erin Wright raised its price target from $325 to $395.

And on Tuesday’s “Lightning Round,” CNBC’s Jim Kramer said he doesn’t like buying the stock he’s been investigating, but “some people seem to know that the worst is over.”

Kraft Heinz skates as Berkshire’s Overhan approaches

In an unusual move for normally passive investors, Buffett told CNBC that he was “disappointed” that the company went ahead with those plans, despite knowing that he, representing KHC’s biggest shareholder, had opposed the split.

Yunli of CNBC.com quotes Gordon Hasket’s Don Bilson saying “beyond the concerns that investors have the plan itself, we have to address the possibility that Buffett will throw away his stock.”

Because its interest is 10% or more, it must publicly report the sale within two business days.

Buffett drops 4 notches on the new Forbes 400 ranking

Warren Buffett and Greg Abell Walkthrough at the Berkshire Hathaway Annual Shareholders Meeting held in Omaha, Nebraska on May 3, 2025.

David A. Grogen | CNBC

Prices Berkshire a The stock, which is almost all source of his net worth, has grown almost 10% over the past year, and Buffett has donated the stock to the Gates Foundation and several family bases this summer.

His Thanksgiving gift to the Family Foundation totaled $1.1 billion last fall.

If Buffett had held on all the shares he had given since 2006, he would now be worth around $350 billion.

It would make him into Elon Musk’s #2 slot behind $428 billion on the annual list that uses stock prices as of September 9th.

the next day, Oracle The stock spiked into a strong earnings report, adding about $100 billion to Larry Ellison’s net worth. Tesla Since then, stocks have also risen.

As a result, Buffett is almost tied to Ellison’s $352 billion in our hypothetical real-time rankings, with Musk still ahead of the line at $463 billion.

Buffett helps CNBC’s “Scoobox” celebrate its 30th anniversary

Buffett around the internet

Some links may require a subscription.

Highlights from the archive

“The power of capitalism is unbelievable” (2011)

Berkshire Stock Watch

Berkshire’s top US ownership – September 5, 2025

Berkshire Top Holdings is making public stocks publicly available in the US, Japan and Hong Kong by market value based on today’s closing price.

Holdings are as of June 30, 2025, as reported in Berkshire Hathaway’s 13th Floor Submission on August 14, 2025.

A complete list of Holdings and current market values is available from the Berkshire Hathaway Portfolio Tracker at CNBC.com.

Questions and comments

Send questions or comments about the newsletter to alex.crippen@nbcuni.com. (I’m sorry, but I won’t forward any questions or comments to Buffett himself.)

If you haven’t subscribed to this newsletter yet, you can sign up here.

Also, Buffett’s annual letter to shareholders strongly recommends reading. Collected here on the Berkshire website.

– Alex Crippen, Editor, Warren Buffett Watch