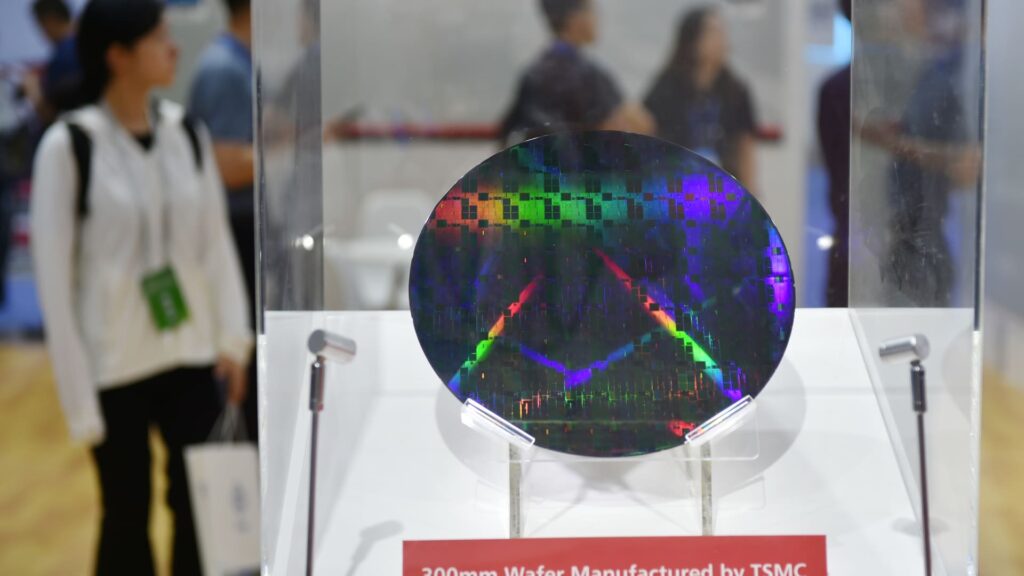

On July 19, 2023, the 300mm wafers on display at the 2023 World Semiconductor Conference held at the Nanjing International Expo Centre in Nanjing, China, were on display at the booth of Taiwanese semiconductor manufacturing companies.

VCG | Visual China Group | Getty Images

The US has revoked its granted waiver Taiwan Semiconductor Manufacturing Co. Exporting key chip-making equipment and technology to manufacturing plants in Nanjing, China, as Washington continues to step up its efforts to limit Beijing’s semiconductor advancement.

This change removes the Fast Track Export privilege known as Verified End User (VEU) status.

The world’s largest contracted chipmaker received an exemption in 2022 shortly after the Commerce Department began its initial restrictions on the sale of US-grown chipmaking tools.

Under the new policy, a US export license will be required to ship chipmaking tools with American origins to TSMC’s manufacturing facility in Nanjing, China.

“We are fully committed to ensuring the uninterrupted operation of TSMC Nanjing while assessing the situation and taking appropriate measures, including communication with the US government,” the company said.

Korean Memory Chip Maker Sk Hynix Samsung also revoked VEU privileges on Friday, according to a statement on the federal register. The two companies operate memory chip facilities based in China.

At the same time, the Department of Commerce’s Industrial Security Bureau said in a statement that it is closing the VEU “Biden-era loophole” for all foreign semiconductor manufacturers.

It added that it intends to grant export licensing applications to allow former VEU participants to operate existing manufacturing facilities in China, but it would not expand China’s capabilities or upgrade technology.

Jeffrey Kessler said under the Secretary of Commerce for Industry and Security, the Trump administration is “committed to closing the loopholes in export controls, especially those that put us businesses at a competitive disadvantage. Today’s decision is a key step in fulfilling this commitment.”

According to Brady Wang, Associate Director of Counterpoint Research, the policy change “reflects Washington’s broader push to strengthen control over the export of semiconductor equipment and technology to China and strengthen the US’s power over China’s chip production.”

TSMC operates two manufacturing sites in China, one in Shanghai and Nanjing, with the latter facility being more sophisticated. To power the manufacturing plants, the company uses hardware from several US chip equipment suppliers. Applied materials and KLA Corp.

However, according to Wang, the financial impact on the company should be “minor” as TSMC’s Nanjing Fab is less than 3% of TSMC’s total revenue, representing a low-capacity share worldwide.

An updated crackdown?

The recent VEU reversal may come as a surprise to some, as it follows the Trump administration’s announcement that it will facilitate control of the exports of some American artificial intelligence chips.

Last month, the US said nvidia and AMD It has signaled that exports of some previously banned Chinese AI chips will be allowed to resume, signaling that the policy can be expanded.

Prior to that, the administration also had broken the Biden-era AI spread rules. This is a move that may have seen an expansion of export controls with advanced AI chips.

The rollback of advanced chip limits has been raised by US authorities as a way for the US to maintain global advantages of the AI technology stack, including China.

However, the removal of the VEU exemption indicates that the same logic is unlikely to apply to memory and chip-making technology.

According to Ray Wang, research director for semiconductors, supply chains and emerging technologies at Futurum Group, the policy shows Washington is still committed to preventing China from increasing local chip production capacity and fostering local know-how and talent.

“Another fundamental goal of zooming out could be to constrain companies’ ability to expand their supply chain footprint in China, particularly in strategic sectors such as semiconductors, which the administration wants to prevent,” he said.

Conversely, the Trump administration has been working to attract more semiconductor supply chains to the US coast through the threat of tariffs.

This year, TSMC, SK Hynix and Samsung have made new investments in American manufacturing plans.

On Monday, SK Hynix and Samsung shares fell to VEU News. However, TSMC’s shares were traded flats on Wednesday after news of a VEU reversal.