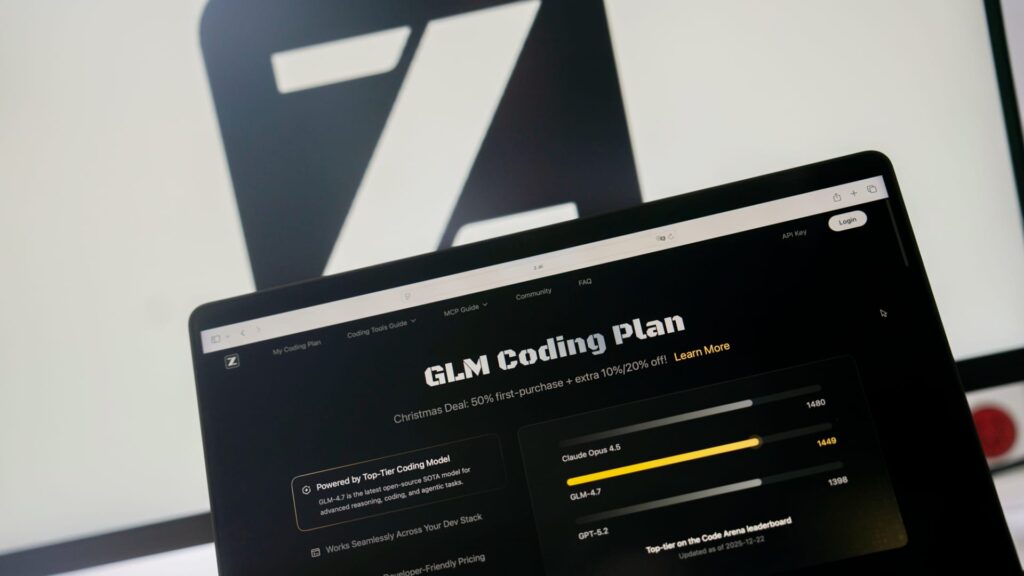

Information about Zhipu’s AI service on the web, called Z.ai, located on a computer in Shanghai on January 7, 2026.

Raul Ariano | Bloomberg | Getty Images

China’s artificial intelligence stocks rose on Thursday as several companies unveiled upgraded models and policymakers renewed calls for widespread adoption of the technology.

Hong Kong-listed Zhipu AI — traded as Knowledge Atlas Technology — Soared 30% after the release of GLM-5, an open source large-scale language model with enhanced coding capabilities and long-running agent tasks.

The company says the model approaches Anthropic’s Claude Opus 4.5 in coding benchmarks and beats Google’s Gemini 3 Pro in some tests. CNBC was unable to verify those claims.

mini max Hong Kong shares rose 11% after the company unveiled its latest M2.5 open source model with enhanced AI agent tools on an overseas website on Wednesday.

The company describes M2 as “a model built for Max coding and agent workflows.”

The rally comes as competition in the AI field intensifies, with Chinese developers releasing a flurry of new models and agents to compete with their American rivals.

New releases have boosted investor sentiment towards AI-related companies. The Shanghai-listed shares of UCloud Tech, which provides computing support to Zhipu, soared 20% on Thursday, reaching a daily high.

SenseTime, which has shifted its focus from developing facial recognition surveillance technology to providing an AI software platform, saw its shares rise 5% in Hong Kong.

Shanghai Star AI Industry Index rose 1.7% to match.

DeepSeek, which took the world by storm last year, on Wednesday upgraded its flagship AI model, adding support for larger context windows and more up-to-date knowledge, according to a report in the South China Morning Post.

Ant Group also released its open source AI model Ming-Flash-Omni 2.0 on Wednesday. The “integrated multimodal model” can generate speech, music, sound effects, and visuals.

ByteDance on Monday unveiled SeaDance 2.0, the latest version of its AI video generation app, sparking a rally in Chinese AI app stocks. The company is also reportedly collaborating with Samsung to develop its own chips.

Shiura AI

Chinese Premier Li Qiang on Wednesday emphasized comprehensive promotion of “large-scale and commercialized applications of AI” and called for better coordination of power and computing resources to advance the technology.

Li also highlighted the Chinese government’s plans to improve the environment for AI talent and enterprises.

The rise of pure-play AI startups comes amid a broader downturn for Chinese tech giants that also have AI divisions. shares of tencent and alibaba They fell by 2.6% and 2.1%, respectively. Hong Kong’s Hang Seng Tech Index fell 1.7%.

Wall Street has seen increased volatility in AI trading this year as investors move from excitement about the technology’s transformative potential to concern about the overvalued valuations of AI companies.

Tai Hui, JPMorgan’s chief market strategist for APAC, told CNBC’s “Squawk Box Asia” on Thursday that he thinks talk of an AI bubble is “a little premature” while there are many blue-chip stocks globally backed by strong fundamentals.

Investors are now making more discerning bets among the major cloud and AI infrastructure providers, Hui noted, but their big spending is supported by underlying profits rather than heavy borrowing.

Chinese technology companies have taken a relatively frugal approach to AI development, focusing on the domestic market with much lower capital expenditures than their U.S. rivals, said Rolf Balck, an analyst at Futurum Group.